For example, you might want to take a look at previously filed tax returns. Check Other Places Your EIN May Be RecordedĪside from confirmation letters from the IRS, you may be able to find a copy of your EIN on other important documents. You or whoever helped you apply may have saved a copy of it for future reference. Look back through your paper and digital business files. Depending on how you apply, you may receive a confirmation letter with your EIN online at the time it was issued or via mail or email. The IRS will notify you when it approves your EIN application. If you previously applied for an EIN and have forgotten it, here are a few possible ways to look up your business tax ID number. Apply for small business financing like business loans and business credit cards.An EIN may also empower your business to complete the following actions: Once you establish an EIN, your business can use the number to pay both federal and state taxes. This nine-digit identifier is a bit like a Social Security number (SSN), but for your business. While taxpayers desperately need efficient access to IRS online services, the IRS also needs to ensure the effectiveness and availability of traditional services, such as sending correspondence to taxpayers, timely responding to or processing replies from taxpayers, and promptly answering telephone inquiries on its toll-free lines.įive research projects are scheduled to begin in FY 2024.On National Funding's Website What Is an EIN?Ī federal tax ID number, or an EIN, is a nine-digit number that identifies your company with the IRS.

TAS recommends that the IRS increasingly incorporate technology into its service offerings, most notably by expanding its online and digital services, while increasing the ease of accessibility of these tools to the vast majority of taxpayers. TAS seeks to use a data-driven approach to improve IRS services for all taxpayers. Read All TAS Case Advocacy and Other Business Objectives -> Reduce Compliance Barriers for Overseas Taxpayers.Improve the Staffing and Culture of the IRS Independent Office of Appeals.Identify Data to Support Minimum Competency Standards for Paid Return Preparers of Federal Tax Returns.Improve Tax Return Processing by Eliminating Barriers to E-Filing.Increase Accessibility and Improve Functionality of Digital Services for Individual and Business Taxpayers and Tax Professionals.Improve Taxpayer Access to Telephone and Face-to-Face Assistance.Improve IRS Hiring, Recruitment, and Training Strategies.

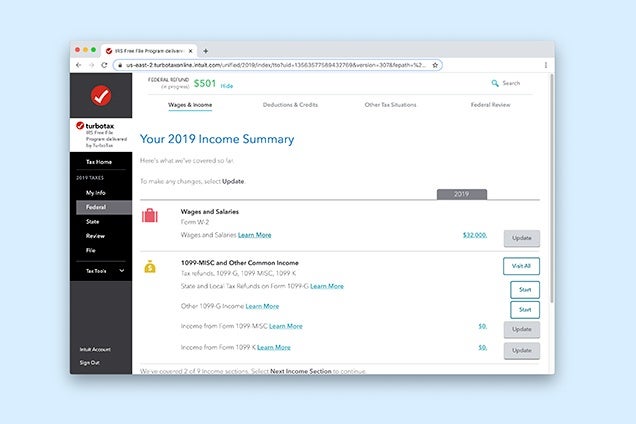

EIN LOOK UP TURBOTAX CODE

Continue to Propose Simplification of the Tax Code and IRS Procedures to Reduce Taxpayer Compliance Burden.Modernize IRS Paper Processing Procedures.Eliminate Systemic Assessments and Offer a First Time Abatement Waiver for International Information Return Penalties.

0 kommentar(er)

0 kommentar(er)